What is an Incurred Cost Submission?

Incurred cost electronic submissions are compilations of various schedules of your costs, presented in a specific way, submitted to the DCAA for their review and audit. The submitted ICE model is a true up of your actual indirect costs incurred over the prior fiscal year to what was provisionally billed.

Why are incurred cost submissions important?

The federal government requires ICE submissions to help verify that the prices paid for cost reimbursable services are both fair and reasonable. A completed ICE submission typically results in an adjustment to amounts billed in the previous year (either under-billed or over-billed). DCAA will review these submissions in a process known as Incurred Cost Audits.

If this is a confusing idea, think of it like a tax return for your billed indirect costs. You always want to be prepared if the IRS shows up at your door. Likewise, it would be smart to treat this process very seriously in the case that DCAA audits your ICE submission(s).

How do I know if I have to complete an incurred cost submission?

ICE submissions are required if any of your contracts are subject to FAR 52.216-7 “Allowable Cost and Payment.” This typically includes most if not all cost reimbursable contracts and some time & materials contracts.

When do I have to complete an incurred cost submission?

ICE submissions are due 6 months after the close of your fiscal year. For most contractors, this deadline is June 30th of each year (calendar fiscal year). However, it could be a different date if your company runs on a different fiscal year.

Any additional tips?

For more information, the above stated ICE model can be found here. DCAA provides instructions for completing the ICE schedules as well as a sample submission.

Completing the ICE Model using PROCAS

If you select the above link and download the ICE model as per the DCAA’s instructions, you will notice that completing the model is no easy feat. (You know you’re in for a long day when an Excel file comes with its own User’s Manual!)

The ICE_Model spreadsheet contains a little more than 25 tabs, all of which require major brain power. To help with this, we’ve built reports for specific schedules that are separated on each tab.

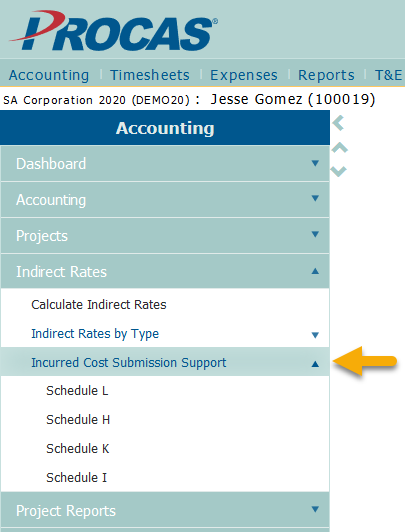

Our reports can be found by going to Indirect Rates –> Incurred Cost Submission Support within the Accounting menu.

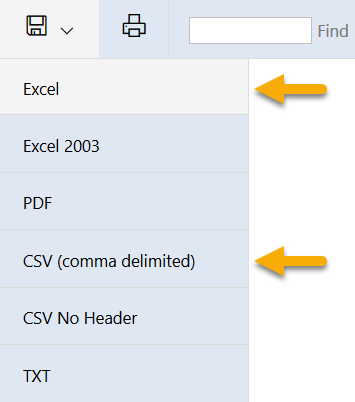

Once each report is printed, they can be downloaded as Excel or CSV files using the downloads option to easily copy and paste your company’s numbers into the ICE model.

The remainder of this post will be broken down into the following sections:

- Calculating Indirect Rates

- Indirect Rate Support

- Schedule H

- Schedule I

- Schedule K

- Schedule L

Note: These reports will only give accurate numbers if…

- Invoices are being billed out of the system

- Costs are recorded correctly

- Rate Calculation Setup has been completed for the fiscal year being submitted

- Indirect Rates have been calculated and applied for the fiscal year being submitted (process covered in the next section)

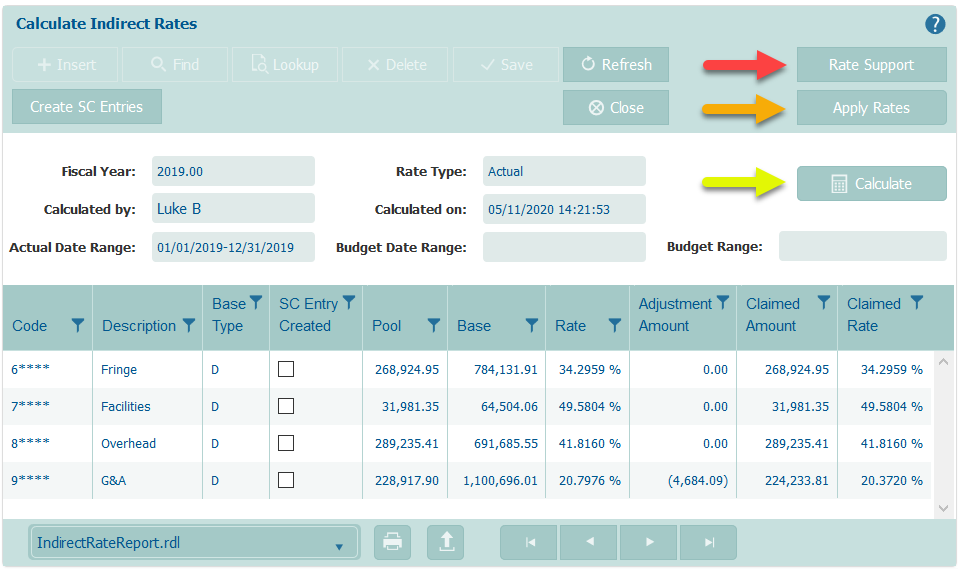

Calculating Indirect Rates

Before we begin gathering any data from the system, we need to calculate and apply our indirect rates for the prior year being reported. This can be done by following the below process:

1.Navigate to Indirect Rates –> Calculate Indirect Rates within the Accounting menu.

2. Scroll back to the prior year using the page up button on your keyboard, or the back arrow ![]() at the bottom of the screen.

at the bottom of the screen.

3. Select the “Calculate” button to the right of the screen. ![]()

- On the pop-up menu, make sure actual rates are selected for the correct date range, then select “Calculate.”

- This will update the numbers on your indirect rates screen, timestamped for the moment they were calculated.

4. Select the “Apply Rates” button in the upper right-hand corner.

- Again, verify the date range is correct, then confirm by selecting “Apply Rates.”

- This will give you a notification that indirect rates have been applied.

5. Navigate to the “Rate Support” button in the right hand corner.

- Continue along to the supporting detail breakdown of your incurred indirect costs.

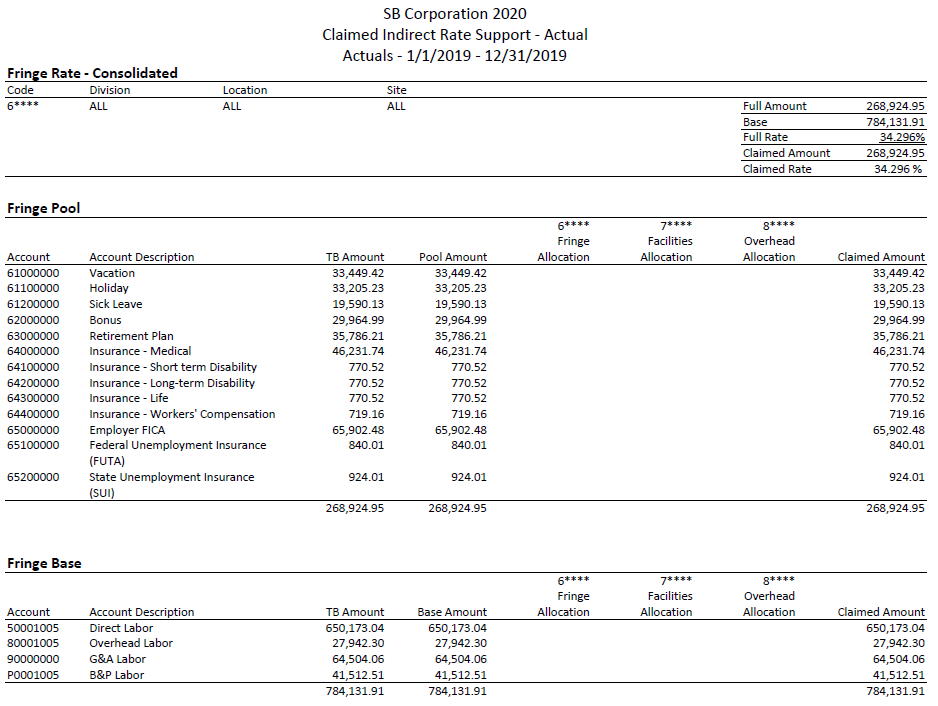

Indirect Rate Support

Now that rates have been calculated, let’s start printing information to start completing our incurred cost submissions. Perhaps the most important, indirect rate support reports contain the details of costs within each pool and base for the rate calculation most recently performed.

The ClaimedIndirectRateSupport.rdl report should be used in completing ICE Model Schedules A, B, C, D, and E and can be downloaded in PDF format as supporting documentation. This report will take into account your indirect rate structure as originally defined under Accounting –> Setup –> Cost Application Rates –> Rate Calculation Setup, and will present data in accordance with this structure.

- On the Indirect Rate Support Report, navigate to the correct fiscal year using the back arrow

.

. - Print ClaimedIndirectRateSupport.rdl using the print icon

.

.

- There are multiple pages to this report –

1 for each of the following indirect rate types:

1 for each of the following indirect rate types:

- Fringe – Page 1

- Facilities – Page 2

- Overhead – Page 3

- General & Administrative – Page 4

- Material Handling & Subcontract Admin – Either combined in one of the previous four pages or split out depending on your rate structure.

- B&P and IR&D – Either combined in one of the first four pages or split out depending on your rate structure.

- Indirect Rate Setup – Final page of the document breaks down your indirect rate structure. This page is a great explanation of what is going on if you are struggling with understanding the numbers!!!

- Export the report to Excel or CSV using the download icon

.

.

You should begin your ICE Model by inserting a new tab in the workbook, which will be used to copy your trial balance information. You should then link information within the various schedules in the ICE Model to the trial balance tab where appropriate. This will leave less room for discrepancies between information in the ICE Model compared to information in your general ledger.

Note: If general ledger adjustments are needed after you have begun the ICE Model, you will only need to update the trial balance information on the trial balance tab.

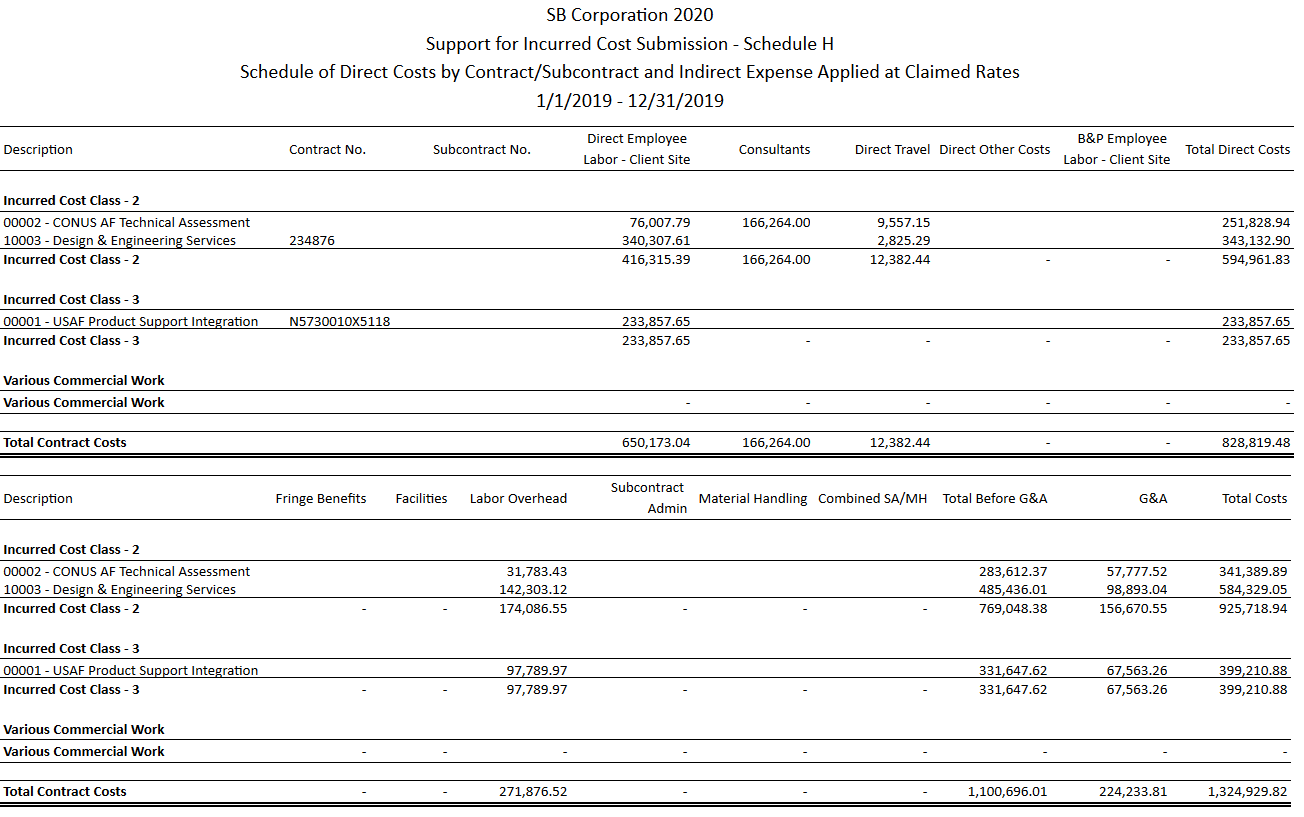

Schedule H

The ICE Model Schedule H is the “Schedule of Direct Costs by Contract/Subcontract and Indirect Expense Applied at Claimed Rates.” The standard Schedule H report accommodates a consolidated overhead rate structure and a two worksite overhead rate structure.

- Indirect Rates –> Incurred Cost Submission Support –> Schedule H

- Indirect rates must be calculated and applied before printing (shortcut located on menu).

- For the report to group the contracts by element of cost class, an Incurred Cost Class code must be established on the project records, invoice task records, and/or the revenue task records.

- The report is available in six roll up levels: Invoice Task, Project, and WBS Levels 2-5.

- The report can be filtered by Department, Division, Location, Site.

Schedule I

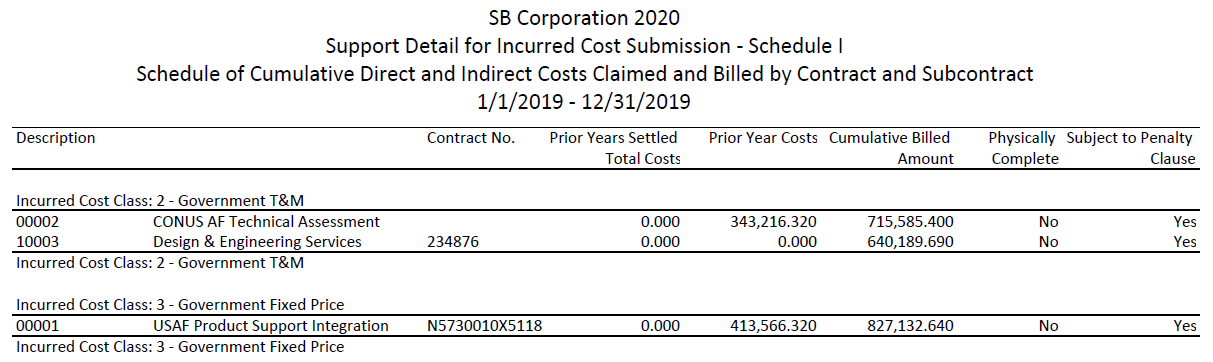

The ICE Model Schedule I is a “Schedule of Cumulative Direct and Indirect Costs Claimed and Billed by Contract and Subcontract.” The automated billing process records billed detail information in Billing History which maintains the inception-to-date billed hours and amounts on contracts. By default, this report will display prior years settled total costs, prior year costs, and cumulative billed amounts, by contract, grouped by incurred cost class for the date range selected. The report displays the contract billed information in cost class order.

- Indirect Rates –> Incurred Cost Submission Support –> Schedule I

- The Schedule I support report requires that the automated billing process is used to create invoices within the accounting system.

- The Schedule I support report in the system requires billing history.

- The report is available in six roll up levels: Invoice Task, Project, and WBS Levels 2-5.

- Select “Search” to populate the applicable task selection screen.

- The report can include or exclude specific tasks by using the checkboxes in the selection screen.

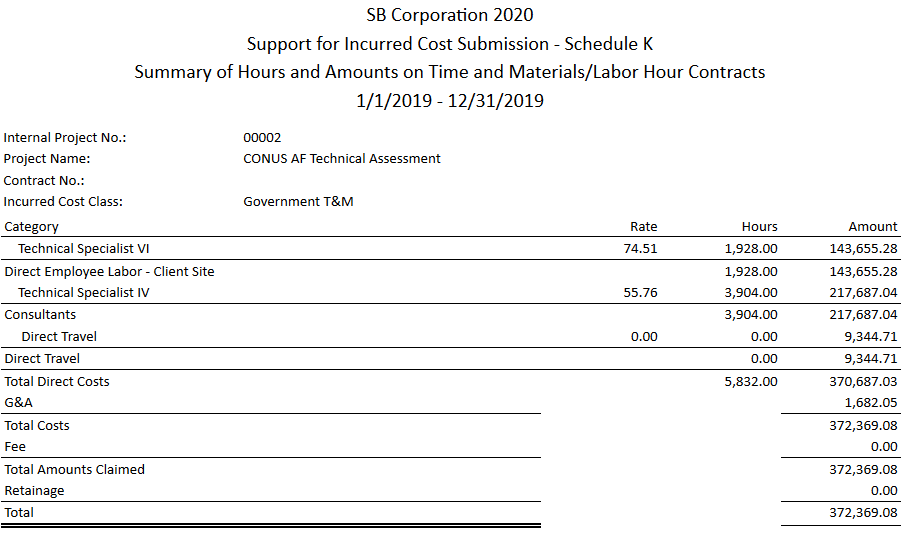

Schedule K

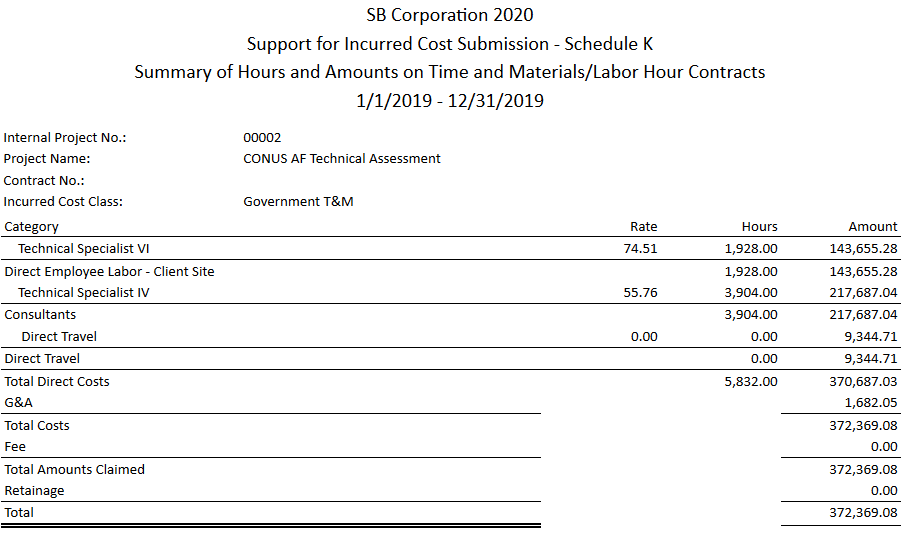

The ICE Model Schedule K is a “Summary of Hours and Amounts on Time and Material/Labor Hour Contracts.” The automated billing process records billed detail information in Billing History which maintains the inception-to-date billed hours and amounts on contracts. By default, this report will display the cumulative hours and amounts billed for the date range selected, regardless of the cost class. The report displays the contract billed information in cost class order. You can filter on a cost class code or a range of cost class codes to isolate the information needed.

- Indirect Rates –> Incurred Cost Submission Support –> Schedule K

- The Schedule K support report requires that the automated billing process is used to create invoices within the accounting system.

- The Schedule K support report in the system requires billing history.

- The report is available in six roll up levels: Invoice Task, Project, and WBS Levels 2-5.

- Select “Search” to populate the applicable task selection screen.

- The report can include or exclude specific tasks by using the checkboxes in the selection screen.

Schedule L

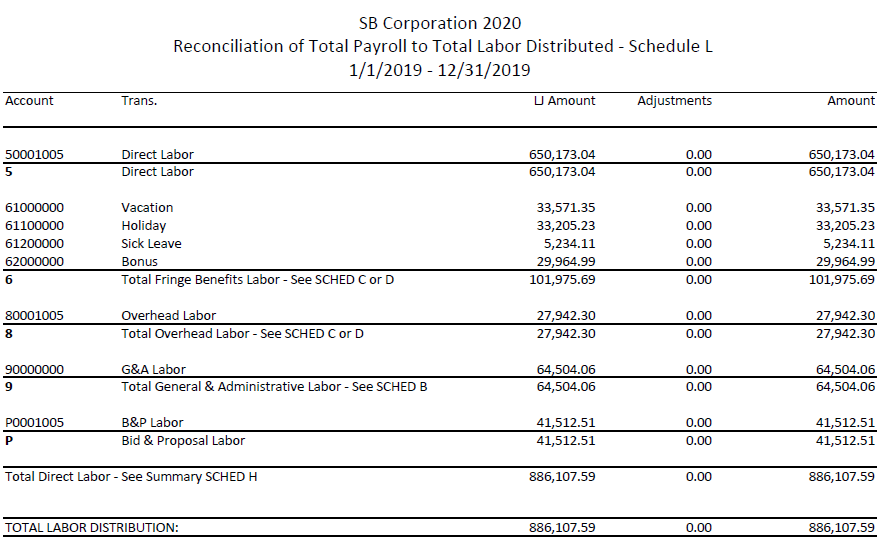

The ICE Model Schedule L is a “Reconciliation of Total Payroll per IRS form 941 to Total Labor Costs Distributions.” It is a reconciliation of the accrual basis labor cost per your general ledger to a cash basis labor cost per the IRS Form 941s. The Schedule L report will display the labor costs recorded in the general ledger, grouped by cost pool.

- Indirect Rates –> Incurred Cost Submission Support –> Schedule L

- Performing a labor reconciliation separately before beginning the ICE Model will help to ensure the information in your general ledger is accurate.

Additional Help

If you’ve made it this far, I applaud your stamina! These reports can seem intense, however they lend a helping hand in completing the associated tabs of the ICE model. For additional help getting the information you need to complete your incurred cost submissions, you can reach us at consulting@procas.com.

Related Tags – ICES, ICP, ICS, Incurred Cost Proposal, Indirect Cost Rate Submission, Final Indirect Rate Proposal